Claims Management System (CMS)

End-to-end digital claims management

GreenTriangle digital claims adjustment provides a seamless and automated process between insurers, loss adjusters, and farmers for more reliable and cost efficient claims adjustment

Optimize costs and accuracy

Reduce costs and increase reliability in the loss adjustment process using our machine learning and remote sensing technology

Real time access to data

Use our mobile app to collect field level data in a systematic way and access your portfolio’s field level data in real-time from anywhere via our web app

Manage moral hazard & fraud

Protect yourself from fraud, document cases when no one can be there in person, and avoid court cases by providing data from remote sensing imagery

Operate anywhere, anytime

Support customers globally with our high quality data on weather and crop conditions world wide

How does it works?

One platform for all

From farmer, to loss adjuster, to insurer, we offer a complete platform for end-to-end claims reporting and management for easy collaboration

Agriculture insurers and reinsurers

Insurers use our platform to reduce their administrative and operating costs as well as to protect from moral hazard and fraud cases. It allows them to increase their underwriting profit.

Reinsurers support the use of our platform to reduce loss adjustment expenses and combined loss ratio

Loss adjusters

Loss adjusters use our mobile and web app to capture claims without any paper work or complex mapping exercises. The necessary information is available at their fingertips on our mobile app. Also to reduce office work because reports are generated automatically and instead focus on the core business of assessing crop condition and measuring crop yield on the field

Farmers

Our platform helps to build trust across the whole risk management value chain by reducing the asymmetry of information. Satellite imagery and correctly documented claims enable all parties to align on the amount of damage and risk involved

22%

Fewer samples

necessary samples thanks to remote peril identification

27%

reduced LAE

loss adjustment costs as a result of better planned sampling campaigns

5%

improved CR

combined loss ratio due to better moral hazard and fraud control

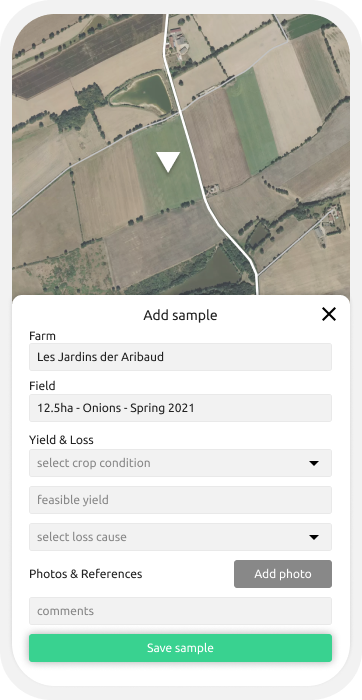

Claims reporting

Digital and instant claims reporting via your smart phone

Collect samples locally and share your insights globally with the right people via GreenTriangle’s simple mobile and web app designed to make the loss adjustment process frictionless and reliable

- Optimize crop cut locations with satellite data

- Verify a claim origin

- Fight fraud

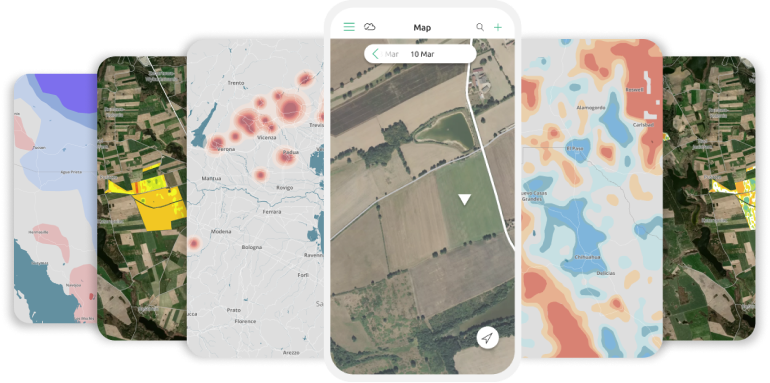

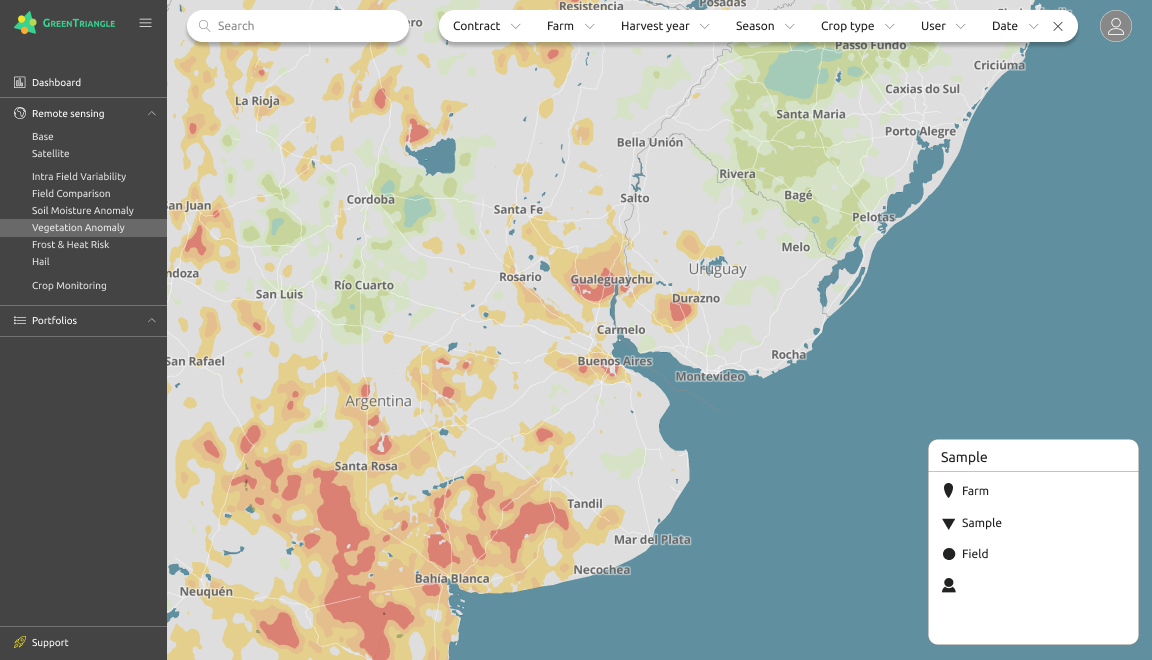

Remote sensing

Increase accuracy and reduce costs in the loss adjustment process

With our mobile app you have state of the art remote sensing technology at your fingertips. Plan your field visits ahead and detect fraudulent claims to reduce costs and improve auditability of your portfolio

Remote sensing maps on your phone and the web app

Satellite imagery

Intra field variability

Field comparison

Soil moisture anomaly

Frost & heat risk

Hail

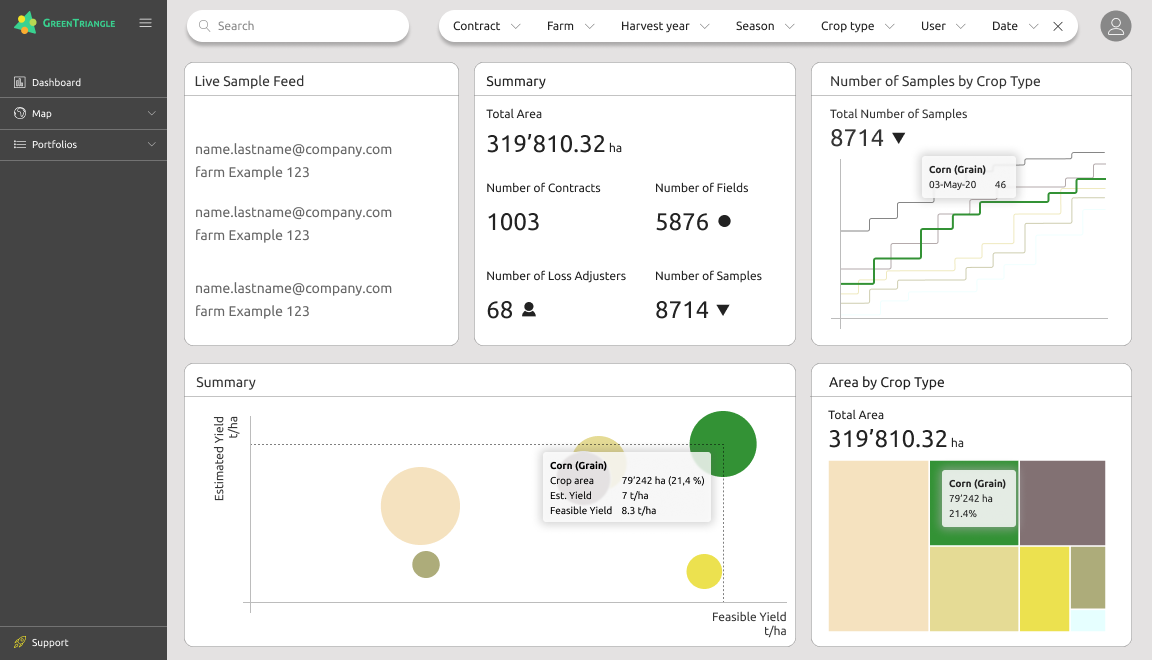

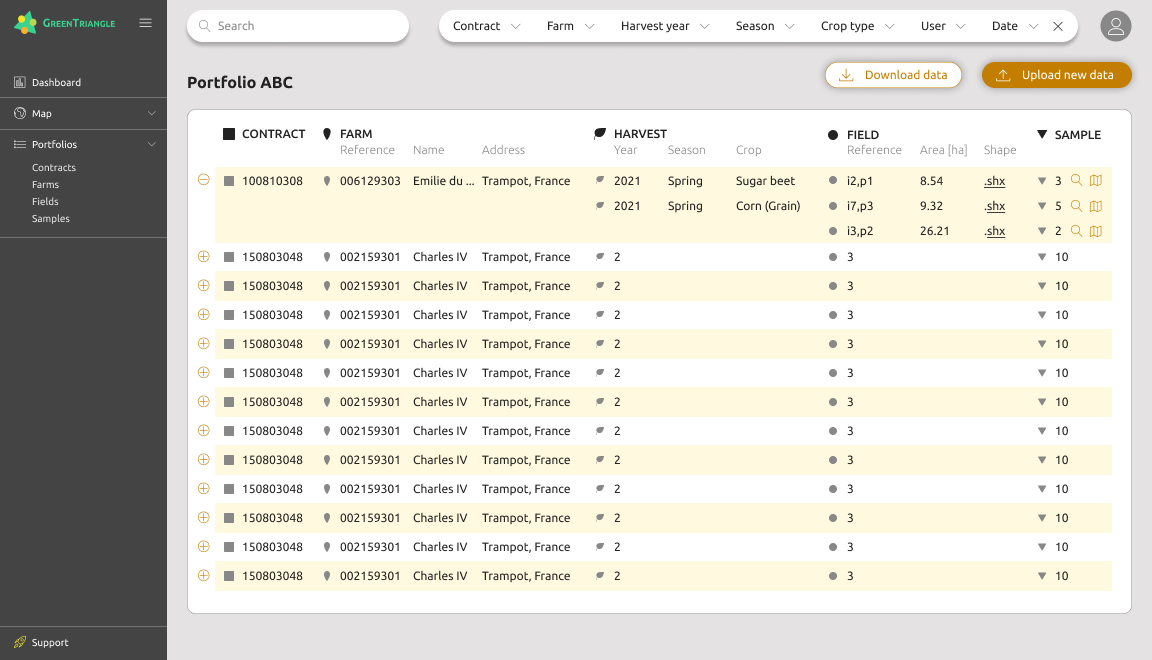

Portfolio management

Real-time analytics and secure access to manage your portfolio from anywhere

GreenTriangle web app is the fastest, most secure, and reliable way to manage your portfolios. Get field level data instantly from around the world and monitor performance of your different portfolios and regions

- Real-time data synchronisation

- Bulk upload your shape files

- Automatically generate portfolio reports

- User based account access

Any more questions? Get in touch.

Start tracking your portfolios and claims via the GreenTriangle platform or set up a pilot project. Contact us to get started.